DemandCasteris concerned about inventory; we look at Inventory, Inventory Turns, Days Coverage and Inventory as a percentage of Sales. Recently we began looking at how the inventory measures might be correlated to other measures. We think we know that inventory is correlated to Cash and Profits. We looked at about forty companies, including the manufacturing firms of the Dow Jones; we collected data from their income statements and balance sheets. We were surprised to find very little correlation between cash, profits, and inventory across these companies. We speculated other relationships and again were surprised that there were no compelling correlations with inventory.

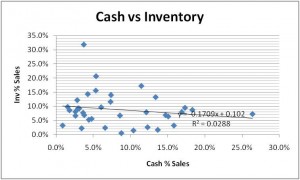

OK maybe profit is not a real surprise. But cash? Inventory performance and cash should be closely related. The general thinking is that more inventory means less cash and vice-versa. It seems intuitive but as a percentage of sales, it is just not the case. The graph below looks truly random and an R2 of .03 is not compelling.

This reminds me of a time in the consumer goods industries when the general management believed with great conviction that inventory and customer service were correlated. The belief was that to improve service, one had to increase inventory. So, they were reluctant to try to improve service as they already believed their inventories were too high. They were absolutely wrong! We were absolutely wrong. High Inventories and Poor Service was a very easy state to achieve. All you had to do was not pay attention to the mix and voila… high inventories and awful service. The “breakthrough” thinking was that companies could both lower inventories and improve service!

Once one optimized inventory and service, then the old thinking was right: To improve service, more inventory is required. The key here is IF inventory and service are already optimized.

Safety Stock = Stand Deviation of Historical Demand x Service Level (z-factor) x Lead Time Factor

So maybe our assumptions on Cash and Inventory independent of service are the equivalent of believing the earth is flat. Interestingly, the one critical measure that we can’t pull from all the financial reporting out there is service.

What do you think? We would love your views on this. As our analysis progresses, we will blog more on this subject. We will be looking at companies within specific industries next.